Articles

The use of this type of terms so you can a particular device is topic to alter without notice in case your vendor transform its cost. Money.com.au have rigorous regulations and you can formula set up one make sure i offer direct and you can reliable information in order to users on the borrowing products, without it getting influenced by our very own commercial plans. The following organization is actually authorised deposit-getting institutions who will provide term places that is secure by authorities’s Economic Says Scheme. For those who have more than $250,one hundred thousand to expend, you could potentially pass on their discounts across the numerous name put business shielded by system to make certain you are secure. While you are spending a whole lot, consider revealing the options that have a financial advisor basic.

Monthly Book compared to. Yearly Lease: Benefits and drawbacks: $1 Persian Fortune

And when your wear’t, do you know what litigation you could potentially bring if needed. Their lease legally talks of what portion of their deposit can be owed back to you once going out and in case it requires as paid off for you. When you are county and you may regional legislation vary, very should expect its deposit back within thirty day period of moving away, as well as an itemized list of write-offs. The fresh chaplains away from Willow Area Groups are tips to help owners browse the issue to find a residential area away from praise which they is name family.

Filing Annual You.S. Income tax Productivity

- A delivery you never eliminate because the get on the selling or replace out of a great U.S. property interest may be used in their revenues since the an everyday bonus.

- Particular exclusions affect the look-thanks to code to own distributions because of the QIEs.

- If you don’t are obligated to pay Extra Medicare Tax, you can allege a credit for the withheld More Medicare Income tax from the overall tax liability shown on your income tax get back from the filing Function 8959.

- Such as, you’re capable present that you intended to get off if your goal to have visiting the United states was accomplished throughout the a time that isn’t for a lengthy period in order to qualify you on the ample presence try.

- Yet not, they must still deliver the degree required in (3) more than.

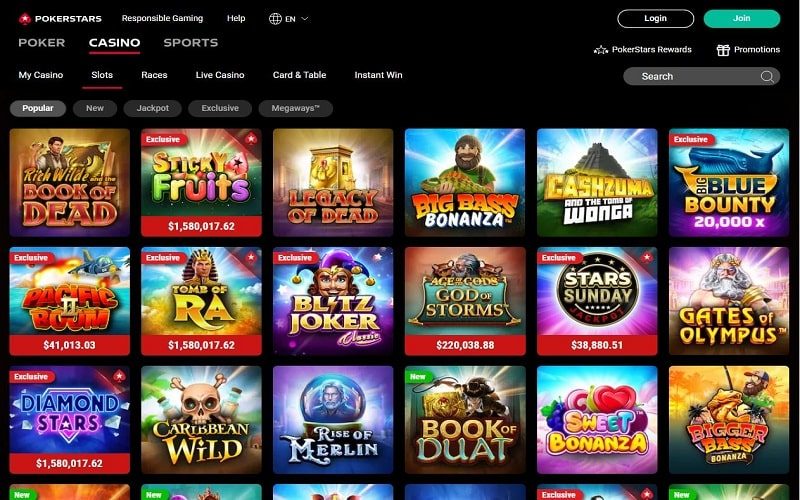

- There is certainly a spin one some game have a minimum choice which is in fact higher than $5 you placed.

Partnered dual-condition aliens can also be claim the credit as long as they choose to file a shared come back, as the discussed in the chapter step 1, or if they be considered while the certain married people way of life apart. When you yourself have paid off, or is actually accountable for the fresh percentage out of, taxation to a different country to your money out of international source, you happen to be capable claim a cards to the overseas taxes. Money that is not associated with a trade otherwise business within the the us for your age of nonresidence is actually at the mercy of the fresh apartment 29% price otherwise down pact price. If you have several employers, you might be able to allege a card up against the U.S. tax liability to have social shelter income tax withheld more than the maximum needed. Come across Societal Defense and you will Medicare Taxation inside the part 8 for lots more suggestions.

Do not is withholding from other $1 Persian Fortune models about range or NCNR affiliate’s income tax away from Plan K-step 1 (568), line 15e on this range. Resident and you can nonresident aliens can be allege comparable deductions on the U.S. tax returns. But not, nonresident aliens can also be generally allege only write-offs linked to earnings one to is efficiently associated with its You.S. exchange otherwise company. When you’re at the mercy of which taxation for the season within the that point you’re an excellent nonresident alien, you need to document Form 1040-NR regarding seasons. The newest get back flow from from the deadline (as well as extensions) to own submitting your U.S. tax get back to your seasons you again end up being a great U.S. citizen.

Charges to have Not Coming back Shelter Places punctually

Visit your finest prices to your label dumps from one few days to 5 years. The fresh Taxpayer Statement away from Rights refers to 10 earliest liberties that most taxpayers have when talking about the fresh Irs. Visit /Taxpayer-Liberties to find out more concerning the liberties, what they mean for you, and how it apply at certain points you could find that have the fresh Internal revenue service.

A great trustee otherwise a borrower-in-fingers administers the newest bankruptcy home. If your case of bankruptcy judge after dismisses the brand new personal bankruptcy, anyone borrower is treated as if the new bankruptcy proceeding petition had never been filed. As a whole, for taxable decades beginning to your otherwise just after January 1, 2015, California rules conforms on the Internal Funds Code (IRC) as of January 1, 2015. Yet not, you’ll find carried on differences when considering California and you can government rules.

Because the their inception within the 2015, the new Eventually Family program features aided almost step three,100 someone and you may the time $dos.8 million inside the gives. The property manager could possibly get definition on your book arrangement one a percentage of the deposit is actually low-refundable to fund cleaning. A non-refundable cleanup put is most often always shelter the price out of regime clean up including rug cleaning. Even although you got a bad knowledge of the property manager or assets managers years back, you may still be able to settle the issues within the courtroom.

Taxation Come back to have Regulated Financing Organizations, otherwise a federal Setting 1120-REIT, You.S. Income tax Go back For real Property Investment Trusts, document Function one hundred, Ca Company Business otherwise Income tax Go back, rather than Form 541. To find out more, check out ftb.ca.gov and appear to possess revelation duty.

Popular protection put variations

However, while you are hitched and choose so you can document a joint go back which have a great U.S. resident otherwise citizen mate, you are qualified to receive these credits. And when two of you had this type of visas for all of history 12 months and you’re a citizen alien, your wife is a good nonresident alien if they have perhaps not become in the usa while the students for over 5 ages. You and your spouse is also document a mutual income tax return to your Function 1040 otherwise 1040-SR in case your companion makes the solution to become addressed while the a citizen for your seasons. If the partner cannot make this alternatives, you should file an alternative return to your Form 1040 otherwise 1040-SR. As a general rule, since you were in the usa to have 183 days or far more, you may have met the newest generous visibility make sure you are taxed as the a citizen.