A balanced capital structure often indicates sound financial management and strategic thinking about the cost of capital. In a low-interest-rate environment, borrowing can be relatively cheap, prompting companies to take on more debt to finance expansion or other corporate initiatives. Different industries have varying levels of capital requirements, operational risks, and profitability margins.

Debt Ratio: What Is It and How to Calculate It

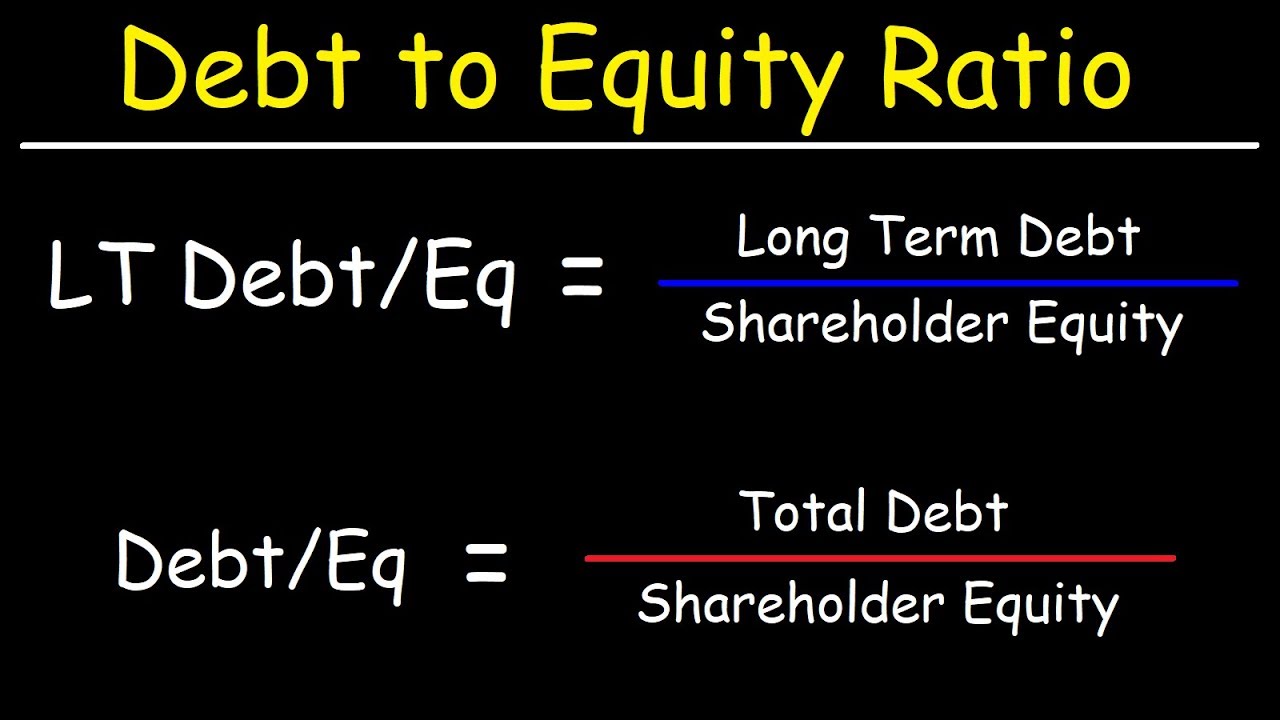

Very high D/E ratios may eventually result in a loan default or bankruptcy. A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Because equity is equal to assets minus liabilities, the company’s equity would be $800,000.

Streamline your order-to-cash operations with HighRadius!

When revenues are high, the company can easily amplify its profits, but when the revenue is low, this high leverage may lead to a strain on the company’s financials. On the other hand, a low debt to asset ratio might imply that the company relies less on debt and would have more flexibility to absorb any financial shocks. This ratio indicates how much debt a company is using to finance its assets compared to equity. A high ratio may suggest higher financial risk, while a low ratio indicates less risk.

Debt Ratio: An In-Depth Examination of Financial Leverage

The following figures have been obtained from the balance sheet of XYL Company. These factors highlight the significance of maintaining a free profit and loss form free to print save and download healthy DTI ratio when pursuing RV financing options. Our website services, content, and products are for informational purposes only.

- In most cases, this is considered a very risky sign, indicating that the company may be at risk of bankruptcy.

- A high ratio may suggest higher financial risk, while a low ratio indicates less risk.

- For stakeholders, the level of risk involved in investing or lending to a company also needs to be evaluated.

- This means the company owes more than it owns, which is considered highly risky.

- Liabilities, on the contrary, are better when treated as a numerator for debt ratio with equity as a denominator.

- The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations.

Now that you know why the debt ratio is important and how to calculate debt ratio, let’s take real-world examples to make it even easier to understand. Think about how these ratios compare to other financial ratios, and we’ll get into that in the next section. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This means that the company can use this cash to pay off its debts or use it for other purposes. However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. Leveraging automation for effective debt management is crucial, where companies face the challenge of optimizing collections processes while maximizing productivity. With HighRadius’ collections management software equipped with AI capabilities, businesses can prioritize their efforts towards the most critical tasks.

Alternatively, if we know the equity ratio we can easily compute for the debt ratio by subtracting it from 1 or 100%. Equity ratio is equal to 26.41% (equity of 4,120 divided by assets of 15,600). Understanding your debt-to-income ratio is crucial when considering RV financing. By keeping your DTI low you not only improve your chances of securing a loan but also position yourself for better terms and interest rates. I’ve seen how a manageable DTI can lead to a more enjoyable RV ownership experience without the stress of overwhelming debt.

Given its purpose, the ratio becomes one of the solvency ratios for investors. This is because the value derived helps them understand how likely those entities are to go bankrupt in the event of consecutive defaults. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Dave’s Guitar Shop is thinking about building an addition onto the back of its existing building for more storage. This understanding is crucial for investors and analysts to ascertain a company’s financing strategy. It offers insights into the company’s long-term solvency and its ability to meet its long-term obligations.