Think of liabilities as obligations — the company has an obligation to make payments on loans or mortgages or they risk damage to their credit and business. Assets typically hold positive economic value and can be liquified (turned into cash) in the future. Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory is very liquid — the company can quickly sell it for money.

Which of these is most important for your financial advisor to have?

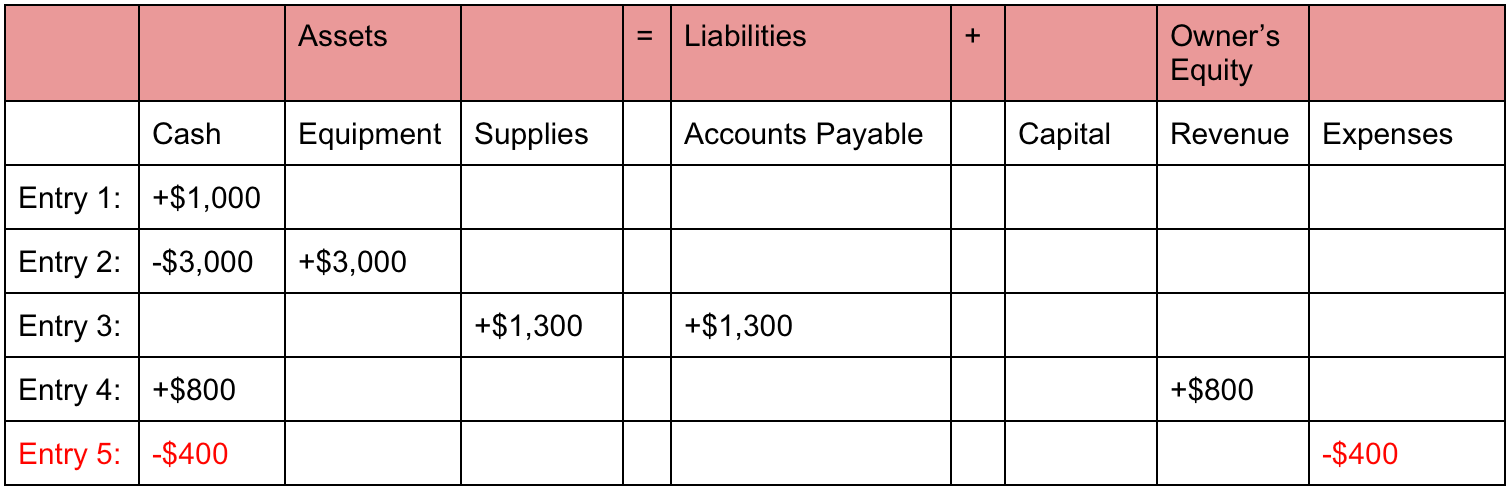

The accounting equation relies on a double-entry accounting system. In this system, every transaction affects at least two accounts. For example, if a company buys a $1,000 piece of equipment on credit, that $1,000 is an increase in liabilities (the company must pay it back) but also an increase in assets. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). As you can see, all of these transactions always balance out the accounting equation.

Why You Can Trust Finance Strategists

The sales tax web file is fundamental to the double-entry bookkeeping practice. Its applications in accountancy and economics are thus diverse. These are some simple examples, but even the most complicated transactions can be recorded in a similar way.

Shareholders’ Equity

Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets. In the above transaction, Assets increased as a result of the increase in Cash. At the same time, Capital increased due to the owner’s contribution. Remember that capital is increased by contribution of owners and income, and is decreased by withdrawals and expenses.

This equation is behind debits, credits, and journal entries. It can be defined as the total number of dollars that a company would have left if it liquidated all of its assets and paid off all of its liabilities. However, equity can also be thought of as investments into the company either by founders, owners, public shareholders, or by customers buying products leading to higher revenue. Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed. During the month of February, Metro Corporation earned a total of $50,000 in revenue from clients who paid cash. Liabilities are amounts owed to others relating to loans, extensions of credit, and other obligations arising in the course of business.

- Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity.

- The balance sheet is also known as the statement of financial position and it reflects the accounting equation.

- Taking time to learn the accounting equation and to recognise the dual aspect of every transaction will help you to understand the fundamentals of accounting.

Ask a Financial Professional Any Question

Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity. The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets.

In the case of a limited liability company, capital would be referred to as ‘Equity’. If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. The company acquired printers, hence, an increase in assets. Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash).

This transaction brings cash into the business and also creates a new liability called bank loan. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings). Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital).

Unearned revenue from the money you have yet to receive for services or products that you have not yet delivered is considered a liability. Before taking this lesson, be sure to be familiar with the accounting elements. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

The accounting equation ensures that the balance sheet remains balanced. That is, each entry made on the debit side has a corresponding entry (or coverage) on the credit side. The accounting equation is not always accurate if it is unbalanced. This can lead to inaccurate reporting of financial statements and incorrect decisions made by management regarding money and investment opportunities.